Exploring the realm of Funding Your Ecommerce Growth with Shopify Capital, this introduction sets the stage for a detailed analysis of how businesses can leverage this financial tool to propel their online growth. Starting with a breakdown of what Shopify Capital entails, we delve into the benefits, eligibility criteria, and various funding options available, painting a vivid picture of the opportunities that lie ahead for ecommerce entrepreneurs.

Introduction to Shopify Capital

Shopify Capital is a funding program offered by Shopify to help ecommerce businesses grow and expand. It provides merchants with access to capital to invest in inventory, marketing, and other business needs.Benefits of Using Shopify Capital

- Quick and Easy Access to Funding: Shopify Capital offers a streamlined application process, allowing merchants to receive funding quickly.

- No Fixed Payments: Repayments are made based on a percentage of daily sales, so there are no fixed monthly payments.

- No Interest Rates: Instead of charging interest, Shopify Capital charges a fixed fee, which is agreed upon upfront.

- Flexible Repayment: Repayments adjust based on sales volume, making it easier to manage cash flow.

Eligibility Criteria for Accessing Funding through Shopify Capital

- Active Shopify Store: Merchants must have an active online store on the Shopify platform.

- Minimum Sales Threshold: Merchants need to meet a minimum sales threshold to qualify for funding.

- Positive Sales Trends: Shopify Capital considers the sales history and growth potential of the business before providing funding.

- Good Standing with Shopify: Merchants must have a good standing with Shopify, including compliance with Shopify's terms of service.

Types of Funding Available

When it comes to funding options offered by Shopify Capital, there are different types available to help ecommerce businesses grow and expand their operations.Merchant Cash Advance

- Merchant Cash Advance is a popular funding option that provides a lump sum of cash in exchange for a percentage of future sales.

- It is a flexible option as repayments are based on a percentage of daily sales, making it easier for businesses during slow periods.

- Businesses can use this funding to invest in inventory, marketing, or expanding their product line.

Loan

- Shopify also offers traditional loans with fixed repayment terms and interest rates.

- Loans provide businesses with a lump sum upfront that is repaid over a specific period of time.

- This type of funding can be used for larger investments like purchasing equipment, hiring employees, or scaling operations.

Revenue Share Agreement

- A Revenue Share Agreement allows businesses to receive funding in exchange for a percentage of future sales until a specified repayment amount is reached.

- It is a flexible option that adjusts repayments based on sales volume, making it suitable for businesses with fluctuating revenue.

- Ecommerce businesses can utilize this funding type to launch new products, improve their website, or invest in marketing campaigns.

Application Process

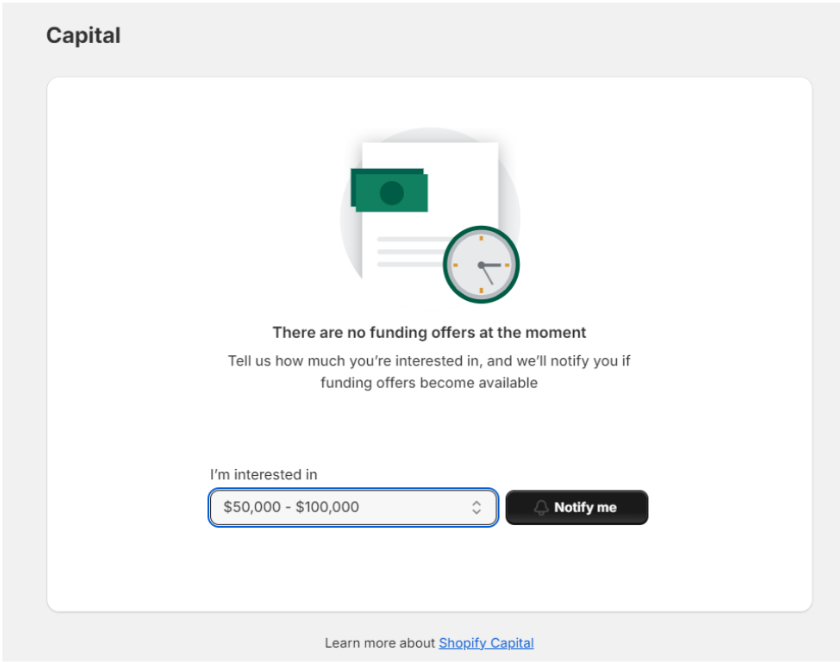

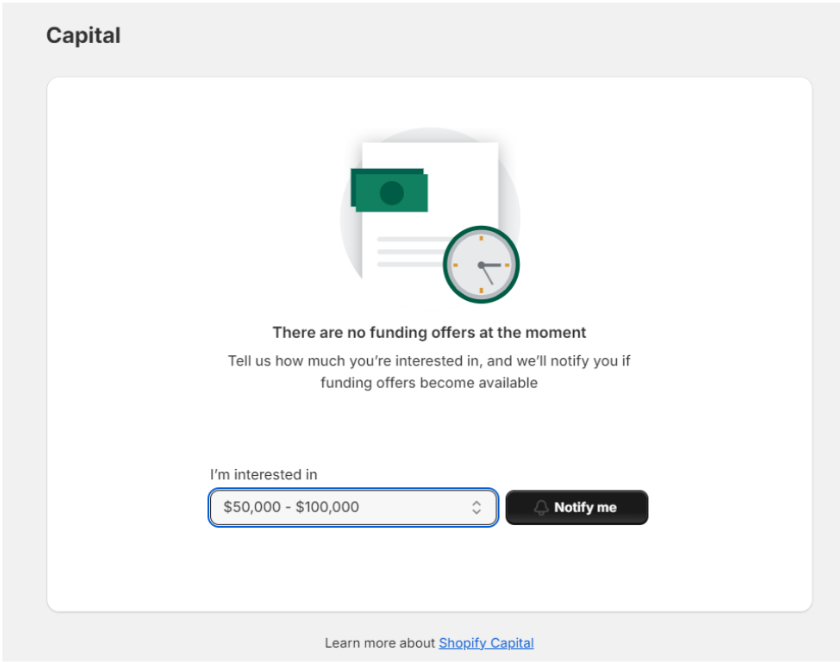

When applying for funding through Shopify Capital, it is essential to follow a structured process to maximize your chances of success. Here, we will Artikel the steps involved in the application process, the documentation required, and tips to increase your chances of securing funding.Steps to Apply for Funding

- Log in to your Shopify account and navigate to the Capital section.

- Check your eligibility for funding based on your store's performance metrics.

- Review the funding options available and choose the amount that suits your business needs.

- Complete the application form by providing accurate information about your business and financials.

- Submit the application and wait for a decision from Shopify Capital.

Documentation and Information Required

- Business information: Legal name, address, and contact details.

- Financial statements: Revenue, expenses, profit margins, and cash flow projections.

- Sales performance: Monthly sales data, growth trends, and customer acquisition strategies.

- Personal information: Details of the business owner(s) and their credit history.

Tips for a Successful Funding Application

- Ensure your financial records are up to date and accurately reflect your business performance.

- Provide clear and concise explanations for any fluctuations or anomalies in your financial data.

- Demonstrate a solid growth strategy and explain how the funding will be used to fuel your ecommerce growth.

- Be transparent about any challenges or risks facing your business and how you plan to mitigate them.

- Maintain open communication with Shopify Capital throughout the application process and respond promptly to any requests for additional information.

Repayment and Terms

When it comes to Shopify Capital funding, understanding the repayment terms and conditions is crucial for the financial health of your ecommerce business. Let's delve into how the repayment process works and how you can effectively manage repayments to avoid any financial strain.Repayment Terms and Conditions

Shopify Capital offers a flexible repayment structure based on a fixed percentage of your daily sales. Here are some key terms and conditions associated with the repayment process:- Repayment Percentage: A predetermined percentage of your daily sales will be automatically deducted to repay the funding.

- No Fixed Monthly Payments: Unlike traditional loans, there are no fixed monthly payments with Shopify Capital, making it easier to manage cash flow.

- Automatic Repayment: Repayments are automatically deducted from your Shopify Payments account, simplifying the process for you.

- No Late Fees: Shopify Capital does not charge late fees, but it's essential to make timely repayments to avoid any penalties.

Managing Repayments Effectively

Effective management of repayments is key to maintaining a healthy financial position for your ecommerce business. Here are some tips to help you manage repayments effectively:- Monitor Cash Flow: Keep a close eye on your cash flow to ensure you have enough funds to cover repayment percentages.

- Plan for Seasonal Variations: Consider seasonal variations in sales and adjust your budget accordingly to avoid cash flow shortages.

- Communicate with Shopify: If you anticipate any issues with repayments, communicate with Shopify to explore alternative solutions or repayment plans.

- Optimize Sales: Focus on optimizing your sales strategies to increase revenue and ensure you can comfortably meet repayment obligations.

Case Studies and Success Stories

In this section, we will explore real-life examples of ecommerce businesses that have leveraged Shopify Capital for growth and analyze the impact it has had on their success.Case Study 1: Jewelry Boutique

One example is a jewelry boutique that used Shopify Capital to invest in new inventory and marketing campaigns. With the additional funds, the boutique was able to expand its product line and reach a wider audience through targeted advertising. As a result, sales increased by 40% within the first year of receiving funding.Case Study 2: Clothing Brand

Another success story is a clothing brand that utilized Shopify Capital to upgrade its e-commerce platform and optimize its website for mobile users. The brand saw a significant boost in online traffic and a 30% increase in conversion rates after implementing these improvements, leading to a substantial growth in revenue.Key Takeaways

- Strategic use of Shopify Capital can lead to tangible business growth and increased profitability.

- Investing in inventory, marketing, and website optimization are common areas where businesses have seen success with Shopify Capital.

- Monitoring key performance indicators and tracking the impact of funding can help businesses make informed decisions for future growth.

- Building a strong relationship with Shopify and utilizing their resources can maximize the benefits of Shopify Capital for long-term success.